Approach

REGAL’S FUNDAMENTAL STRATEGIES UTILISE RESEARCH DRIVEN, BOTTOM UP STOCK SELECTION AND ARE FOCUSED ON AUSTRALIA AND THE BROADER ASIAN REGION

INVESTMENT PHILOSOPHY

Through fundamental research Regal selects shares that it believes are undervalued and are expected to rise in price. In addition, the strategies utilise Regal’s expertise and systems to sell shares that it believes are overvalued and take advantage of a falling share price. This practice is known as ‘shorting’ and sets Regal apart from many other traditional investors as it creates more opportunity for alpha generation.

INVESTMENT PROCESS

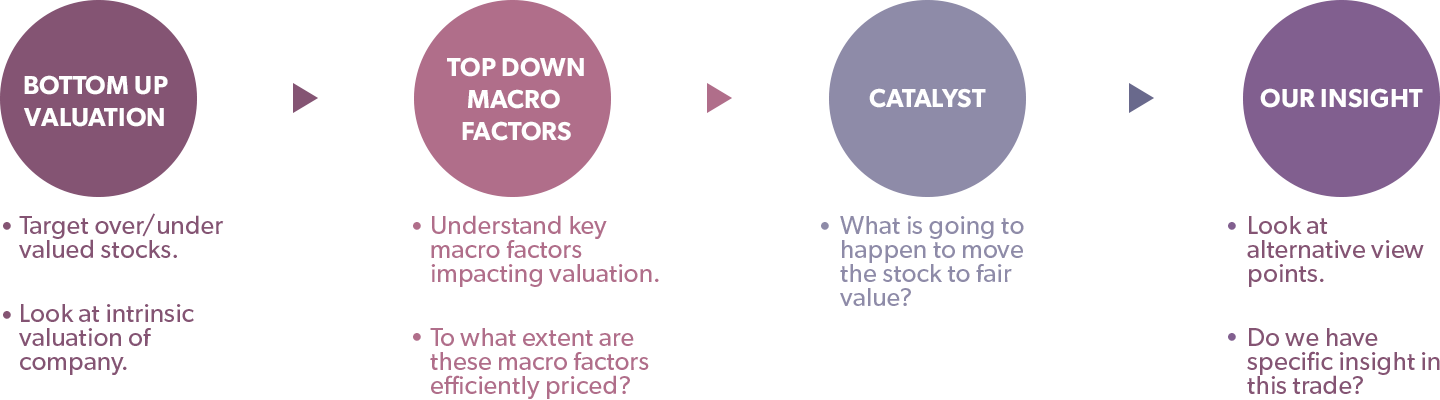

The investment process for our funds focuses on a four-step stock selection process, which emphasises the bottom-up valuation of companies.

The diagram below shows the key factors that are considered when selecting investments. It is important to note that the ‘starting point’ for all investments is almost always a bottom-up stock selection.

As a result, the investment management team spends considerable time meeting with the management of companies in which we invest, as well as talking to their suppliers, customers and competitors. However, meeting management is not a pre-requisite for investing.

Unlike many traditional long-short managers our investment process does not stop with a bottom-up valuation. We seek to identify the macro factors and trends affecting a company. This allows us to choose whether we hedge these risks away or seek to benefit from them.

We also seek to identify a catalyst that will change the market’s perception of value. Minimising the time of investment greatly reduces risk.

And finally, we ask ourselves the question, ‘What is our insight in this trade?’ Admitting we are fallible and identifying our insight in a trade helps us to minimise mistakes.